Swing trading turned out to be a disaster - I gave up USD1k profit from a 6J short THREE times in 5 days, and ended up scratching the trade today.

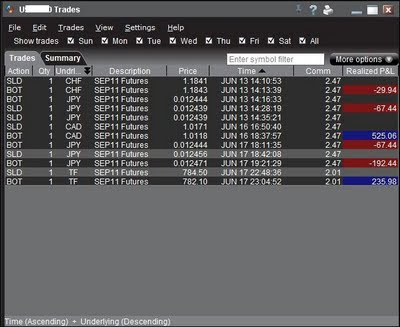

PnL for the weeek:

Share |

Save for that 1 day that I went out with a friend who flew in from HK, I was by the screen almost all my waking hours the entire time that I had held the trade. Whenever I wasn't feeling terribly depressed, I would read the local news to kill time. Yesterday, I spent 4 hours (1am to 5am local time) reading up China's history. I think it was a Wed that I decided to short the CAD to hedge against my 6J short (which was already in the 500 - 800 profit range), and it was about the only fruitful thing that I did in the 5 days.

Long story short, I regret my decision to explore swing trading. The only position I can hold is a losing one, and I should really just stick with what I do best.

PnL for the weeek:

Share |

12 comments:

I love how all Jules trading "disasters" are actually profitable.

Maybe you should just call these kind of results less than desirable. :)

This is about trading and not about keys in a fruit-bowl, right? :-)

[If 'keys in a fruit bowl' is a peculiarly British past-time then I apologise for making even less sense than usual]

I second Solfest's first comment.

I had to look up the "keys-in-fruit-bowl" reference made by the second questionable commenter (Jules, you really need to filter who you let in here!).

Then I had to second Solfest's second comment...and add a slow head shake for good measure.

-AT

You and I clearly have different definitions of the word "disaster". =)

I have the solution to your problem - 6J has a long term rising trend. It's far better to stack the deck in your favor and swing in the direction of the long term trend so time is on your side. That will let you swing the right way using the right fruit bowl, I mean trend. Lol! >:)

I see you are much more active in currencies these days. I find it perplexing that you think your oil trading skills won't transfer to other products. Shouldn't the chart analysis is similar?

Now that I'm done with my "real" disaster trade in CF (only to see it finally collapse this week...argh!), I can now return to more active trade updates as well. =)

I love you so much you really endavoured to become a daytrader my dream too

LOL!!!

@ Solfest, LW and AT:

I see you guys are having fun here so I shall take my time to find out what "keys in a fruit bowl" is all about. The only fruit bowl I'm familiar with is a kick ass fruit platter we call "Rojak" (http://en.wikipedia.org/wiki/Rojak). Hur hur hur....

@ Soulfire:

I had every intention to drop a comment after I realized you were writing about me (ahem) but I couldn't, because I had accessed your site from my very tiny notebook which I couldn't really type on...long story. Regarding hard stop - I agree that it's a necessary evil. I've yet to find the best way to place it though. The more I read about stops, the more they frustrate me, and I always end up having to look for solace in "Stops are for Sissies". LOL!!!

@ Raphael:

THANK YOU :-) No one loves me anymore after my 16th birthday. See how Solfest is having a hard time believing you? Ha.

But seriously, I thank you for your note, and wish that you will realize your dream soon :-)

To swing or not to swing...

http://en.wikipedia.org/wiki/Sex_party#Key_party

Sorry for lowering the tone.

I'm not buying the fact that AT had to look it up though. He is very mysterious about his 'day job' and I think we may finally be getting closer to knowing the industry he works in :-)

No comment.

LW :) Yes I watched a documentary (I vividly remember it was an American production...hmmm) on that almost a decade ago. The subject heading was carefully chosen to lure the cyborg twins out. >:-> I kinda expected to see AT and Daytrader too, and am still wondering where on earth DT is!

@ Soulfire:

I tried to leave this comment on your site (it won't allow me!!! I learned from you, and copied the comment before posting. Hur hur..):

Sorry about your CF short, Soulfire! I know how it feels. Been there too many times. Regarding initial stops, ever consider using fixed dollar stop or stops based on hourly / daily candle stick patterns e.g. below a piercing/bull engulfing line, above a dark cloud/bear engulfing line, etc?

I chanced upon your old site and it says you're born in June? There's only one Soulfire on Xanga, correct? :-)

I managed to type an entire comment on my fujitsu notebook! HA!

@Jules:

Dear dear Jules, I thought you were going to have D fix this insufferable firewall problem that keeps you a prisoner of your own webpage. When will you be getting this problem finally fixed????? =)

There are two "Soulfires" on xanga- one good, the other evil....heh! =) Actually the other Soulfire is/was a different person- which is why I spell my name with two "L"'s. We do share the same trait of being outspoken. ;-)

I use candlesticks as a secondary measure at support/resistance trend lines. Stocks can be far too volatile with engulfing bull candles directly followed by engulfing bear candles or vice versa....only to reverse again. Also, some major candle moves can be big ones requiring a wide stop placement. Using supp/res allows me to reduce stop distance.

Commodities seem to be much more linear, which would suit direct candle use much better.

Oh yes, Soulfire, D did do something...and now I can't comment on wordpress too. LOL!! We suspect it was ME who re-configured something and that was why D couldn't identify the problem (he'll probably need 2 weekends to find out).

Strange, I actually think that candlesticks are better applied to stocks...hmmmm....

You have an evil twin??? LOL!! He's a Gemini by the way :-)

Post a Comment